iSPECIAL MOBILITY ECOSYSTEM

ASSET BACKED SECURITY

UGANDA: CAPITAL MARKETS (ASSET BACKED SECURITIES) REGULATIONS, 2012

"An asset backed security (ABS) is a security whose income payments and hence value are derived from and collateralized (or "backed") by a specified pool of underlying assets."

"The pool of assets which is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues."

"Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, uses the proceeds of the sales to pay back the bank that created, or originated, the underlying assets. The special purpose vehicle is responsible for "bundling" the underlying assets into a specified pool that will fit the risk preferences and other needs of investors who might want to buy the securities, for managing credit risk – often by transferring it to an insurance company after paying a premium – and for distributing payments from the securities. As long as the credit risk of the underlying asset is transferred to another institution, the originating bank removes the value of the underlying assets from its balance sheet and receives cash in return as the asset backed securities are sold, a transaction which can improve its credit rating and reduce the amount of capital that it needs. In this case, a credit rating of the asset backed securities would be based only on the assets and liabilities of the special purpose vehicle, and this rating could be higher than if the originating bank issued the securities because the risk of the asset backed securities would no longer be associated with other risks that the originating bank might bear. A higher credit rating could allow the special purpose vehicle and, by extension, the originating institution to pay a lower interest rate (and hence, charge a higher price) on the asset-backed securities than if the originating institution borrowed funds or issued bonds."

■ Capital Markets Regulatory Framework – Quest for Asset Backed Security (ABS) Letter Received on 22nd April 2014

■ Provisional Prospectus Framework – Cover Sheet

■ Transaction Structure Diagram

■ Source of Funds Diagram

■ Priority of Payments Diagram

■ Transaction Parties and Documents Diagram

DOMESTIC REVENUE MOBILIZATION STRATEGY (DRMS) – UGANDA REVENUE AUTHORITY (URA)

The core objective of the DRMS is to improve revenue collection and lift Uganda's Tax-to-GDP Ratio to somewhere between 18-20% within five years of its implementation.The strategy targets to change the way revenue is raised by targeting the following:

1) Lifting the capacities of the revenue administration entities to ensure that revenue is raised in an economically efficient way that reduces the compliance burden for individuals and businesses;

2) Enhancing transparency and accountability in the tax solution, make it harder for the few who would subvert our society to engage in dishonesty and fraud;

3) Enhancing taxpayer service delivery, deepening taxpayer education and access to information to ensure that we are all on one path together.

The above three areas drive the strategic direction of Uganda Revenue Authority (URA). The DRMS further sets the pace for URA's Operations by focusing on key areas to tackle weaknesses across the entire compliance continuum which include the following: Accuracy of the Tax Register, timely and accurate filing, timely processing of refunds, improvement of the effectiveness of Non-Tax Revenues and above all Data Management and Optimization.

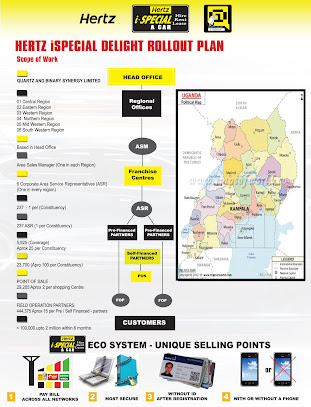

TREASURE THE PEARL, RIDE SPECIAL MOBILITY: UGANDAN TRUST FUND MOOTS AN INTEGRATED MOBILITY PLATFORM FOR AFRICA AND BEYOND

■ Based on our Recognition of the Uganda Revenue Authority (URA) aspirations as enshrined in the Domestic Revenue Mobilization Strategy (DRMS), We diligently propose to deploy the DALIFAiSPECIAL INTEGRATED MOBILITY PLATFORM to enable the Taxpayer transition from the Disruptions foisted upon the Global Economy by the COVID-19 Pandemic.

■ The proposed platform shall facilitate Taxpayer Conservation of Cash; Tax Wise financing of the required motor vehicles to conduct Business/Private Operations; Concentration of the available limited funds towards execution of Core Revenue/Income Generation Activities; Steering clear from the Risk of Obsolescence arising from Outright Private/Public Vehicle Ownership, And the attendant lack of In-Usage and/or Post-Usage ACRISS / DISPOSAL (e.g, the PPDA statutory constraints) Flexibility.

Premised on the above scenarios, Please find Shared the highlights of our Proposed DALIFAiSPECIAL Mobility Ecosystem – Salient Execution Mechanics that seek to champion the Pearl of Africa aspirations in the wake of the "Visit Uganda, Invest in Uganda" ( Destination Uganda ) campaign dubbed " EXPLORE UGANDA, THE PEARL OF AFRICA" that was launched on 21st January 2022 at Kololo Ceremonial Grounds by His Excellency, the President of the Republic of Uganda, Yoweri Kaguta Tibuhaburwa Museveni.

No comments:

Post a Comment