Saturday, January 22, 2022

iSPECIAL QUEST FOR AN INITIAL USD($)110M WORTH OF ASSET BACKED SECURITIES, THE FIRST IN UGANDA SINCE GAZETTING THE REGULATIONS ON JUNE 29, 2012

"An asset backed security (ABS) is a security whose income payments and hence value are derived from and collateralized (or "backed") by a specified pool of underlying assets."

"The pool of assets which is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues."

"Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, uses the proceeds of the sales to pay back the bank that created, or originated, the underlying assets. The special purpose vehicle is responsible for "bundling" the underlying assets into a specified pool that will fit the risk preferences and other needs of investors who might want to buy the securities, for managing credit risk – often by transferring it to an insurance company after paying a premium – and for distributing payments from the securities. As long as the credit risk of the underlying asset is transferred to another institution, the originating bank removes the value of the underlying assets from its balance sheet and receives cash in return as the asset backed securities are sold, a transaction which can improve its credit rating and reduce the amount of capital that it needs. In this case, a credit rating of the asset backed securities would be based only on the assets and liabilities of the special purpose vehicle, and this rating could be higher than if the originating bank issued the securities because the risk of the asset backed securities would no longer be associated with other risks that the originating bank might bear. A higher credit rating could allow the special purpose vehicle and, by extension, the originating institution to pay a lower interest rate (and hence, charge a higher price) on the asset-backed securities than if the originating institution borrowed funds or issued bonds."

■ Capital Markets Regulatory Framework – Quest for Asset Backed Security (ABS) Letter Received on 22nd April 2014

■ Provisional Prospectus Framework – Cover Sheet

■ Transaction Structure Diagram

■ Source of Funds Diagram

■ Priority of Payments Diagram

■ Transaction Parties and Documents Diagram

The core objective of the DRMS is to improve revenue collection and lift Uganda's Tax-to-GDP Ratio to somewhere between 18-20% within five years of its implementation.The strategy targets to change the way revenue is raised by targeting the following:

1) Lifting the capacities of the revenue administration entities to ensure that revenue is raised in an economically efficient way that reduces the compliance burden for individuals and businesses;

2) Enhancing transparency and accountability in the tax solution, make it harder for the few who would subvert our society to engage in dishonesty and fraud;

3) Enhancing taxpayer service delivery, deepening taxpayer education and access to information to ensure that we are all on one path together.

The above three areas drive the strategic direction of Uganda Revenue Authority (URA). The DRMS further sets the pace for URA's Operations by focusing on key areas to tackle weaknesses across the entire compliance continuum which include the following: Accuracy of the Tax Register, timely and accurate filing, timely processing of refunds, improvement of the effectiveness of Non-Tax Revenues and above all Data Management and Optimization.

■ Based on our Recognition of the Uganda Revenue Authority (URA) aspirations as enshrined in the Domestic Revenue Mobilization Strategy (DRMS), We diligently propose to deploy the DALIFAiSPECIAL INTEGRATED MOBILITY PLATFORM to enable the Taxpayer transition from the Disruptions foisted upon the Global Economy by the COVID-19 Pandemic.

■ The proposed platform shall facilitate Taxpayer Conservation of Cash; Tax Wise financing of the required motor vehicles to conduct Business/Private Operations; Concentration of the available limited funds towards execution of Core Revenue/Income Generation Activities; Steering clear from the Risk of Obsolescence arising from Outright Private/Public Vehicle Ownership, And the attendant lack of In-Usage and/or Post-Usage ACRISS / DISPOSAL (e.g, the PPDA statutory constraints) Flexibility.

Premised on the above scenarios, Please find Shared the highlights of our Proposed DALIFAiSPECIAL Mobility Ecosystem – Salient Execution Mechanics that seek to champion the Pearl of Africa aspirations in the wake of the "Visit Uganda, Invest in Uganda" ( Destination Uganda ) campaign dubbed " EXPLORE UGANDA, THE PEARL OF AFRICA" that was launched on 21st January 2022 at Kololo Ceremonial Grounds by His Excellency, the President of the Republic of Uganda, Yoweri Kaguta Tibuhaburwa Museveni.

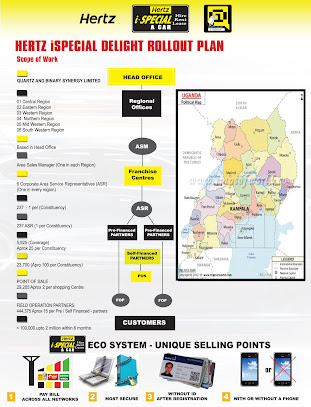

DALIFAiSPECIAL (HZiQZProjectUganda) Salient Execution Mechanics

■ Partnership Liquidity Portfolio Re-Balancing Schematic

Monday, January 17, 2022

iSPECIAL – WHOLE BUSINESS/OPERATING ASSET SECURITIZATION

iSPECIAL MOBILITY ECOSYSTEM

Trust Law inherent in the Discharge and Appropriation of the Lessee/Lessor Interest in Financed Assets (DALIFA) is a Panacea that immortalizes the Asset Backed Securities Regulations as prescribed by the Capital Markets Authority – Uganda.

Trust Law:

A) It is trite law that a trust is a three-party fiduciary relationship in which the first party, the Settlor, transfers ("settles") a property upon the Second Party (the Trustee) for the benefit of the Third Party, the Beneficiary;

B) The Settlor turns over part of his or her bundle of rights to the Trustee, separating the property's legal ownership and control from the equitable ownership and benefits;

C) While the Trustee is given title to the trust property, in accepting the property title, the trustee owes a number of fiduciary duties to the beneficiaries. The primary duties owed include the duty of loyalty, the duty of prudence, the duty of impartiality;

D) To ensure beneficiaries receive their due, the trustees are subject to a number of ancillary duties in support of the primary duties, including: duties of openness and transparency, duties of record keeping, accounting, and disclosure. In addition, a Trustee has a duty to Know, Understand, and Abide by the terms of the Trust and relevant Law;

E) There are strong restrictions regarding a Trustee with Conflict of Interest; Courts can reverse a Trustee's actions, Order profits returned, and Impose other sanctions if they find a Trustee has failed in any of their duties. Such a failure is termed a breach of trust and can leave a neglectful or dishonest Trustee with severe liabilities for their failure.

UGANDA CASE LAW: PRECEDENT THAT INFERS THE SUPREMACY OF TRUST LAW IN THE PRESERVATION OF WEALTH

EMARALD HOTEL LTD & ORS VS BARCLAYS BANK OF UGANDA LTD & ORS, HCT-00-CC-CS 170 of 2008, [2016],Pg 95

Hon. Mr. Justice Lameck N. Mukasa (as he then was, now retired), while considering the law relating to the duty of a receiver or mortgagee selling property pursuant to a power of sale contained in a mortgage as cited by both party counsels: Cuckmere Brick Co. Ltd Vs Mutual Finance Ltd [1971] Ch. 949, where the Court stated:

"It is well settled that a mortgagee is not a trustee of a power of sale for the mortgagor. Once the power has accrued, the mortgagee is entitled to exercise it for his own purposes whenever he chooses to do so. It matters not that the moment may be unpropitious and that by waiting a higher price could be obtained. He has the right to realize his security by turning it into money when he likes. Nor in my view is there anything to prevent a mortgagee from accepting the best bid he can get at an auction even though the auction is badly attended and the bidding exceptionally low, providing none of those adverse factors is due to any fault of the mortgagee, he can do as he likes. If the mortgagee's interests as he sees them conflict with those of the mortgagor, the mortgagee can give preference to his own interests, which of course he could not do were he a trustee of the power of sale for the mortgagor........" (EMPHASIS ADDED) I accordingly conclude both in principle and authority that a mortgagee in exercising his power of sale does owe a duty of care to take reasonable precaution to obtain the true market value of the mortgaged property at the date on which he has decided to sell it. No doubt in deciding whether he has fallen short of that duty the facts must be looked at broadly and he will not be adjudged to be in default unless he is plainly on the wrong side of the line." – As emphasized by Hon. Mr. Justice Lameck M. Mukasa (As he then was, now retired).

Securitization:

It is a process in which an entity securitizing its assets is not borrowing but selling a stream of cash flows that otherwise accrue to it. It is a process through which an issuer creates a financial product by combining other financial assets and then marketing different tiers of the repackaged instruments to investors for the issuer's funding. The repayment of securities is exclusively dependent on the performance of the assets.

WHOLE BUSINESS/OPERATING ASSET SECURITIZATION VS LEVERAGED FINANCE

"Whole-business or operating-asset securitization are set up in a fundamentally different manner than leveraged finance. Bank/bond deals are predicated on companies using their balance sheet on a full recourse basis to secure financing. The lender in these transactions requires extensive covenants that regulate the conduct of borrower's business and use of its assets. Profits from the business are limited by dividend and investment restrictions."

"In contrast, whole-business or operating-asset securitization is a strategy that seeks to isolate the operating assets from the credit risk of the parent entities so that the lender is relying primarily on the value of the assets in making the loan. Candidates for this type of finance hold valuable intellectual property or recurring contract revenue that can be exploited over a considerable period of time. Covenants in whole-business deals are generally focused on maintaining the value of assets so that debt service coverage is maintained. An affiliate of the parent company may be retained to manage the operating-asset securitization, but such an affiliate may generally run the business as it has done so before the securitization."

"The manager and the parent are not subject to restrictions on how they can profit from the business, except in situations where the assets are not performing as expected. In the case of operating assets, the manager on behalf of the securitization entities is required to continue to expend effort to exploit the assets. An example, in a securitization of fast food royalties, the securitization issuer through the manager is required to utilize the fast food chain's intellectual property in order to originate new franchises, thus generating revenue to service the securitization debt. The same may be said about patents and drug royalties or clothing licenses and their associated trademark."

"In traditional securitization, the contractual cash flows under credit cards, mortgages, or leases are conveyed into a special-purpose subsidiary of the parent in a "true sale" transaction. Stated more simply, the sale is supposed to be structured in such a way that if the parent becomes bankrupt, the assets and cash flow that have been securitized will not be included in the bankruptcy estate of the parent. Likewise, the special-purpose subsidiary is established with certain corporate requirements that ensure that it will not be "substantively consolidated" with the parent in the case of the latter's bankruptcy."

Transaction Structure Description

Type of Transaction

Rental Car ABS transactions have been financed either through commercial paper or as a term transaction.

Rental car term transactions have typically been structured using a master trust where the issuer may issue multiple series of both fixed and floating rate notes. This is similar to a credit card master trust which is used to finance a revolving pool of collateral. In this case, the collateral is the fleet of vehicles which are either turned back to the manufacturer or sold within a relatively short period of time [in Uganda typically within three (3) years]. Most rental car ABS transactions have been insured by a monoline bond insurer but they may also be issued using a senior-subordinate structure.

Most rental car fleet transactions are structured as a true lease (operating lease). In a true lease transaction, the vehicles are titled in the name of the SPE with the indenture trustee/custodian named as lienholder on the certificates of title. This will enable the transaction to be structured to be bankruptcy remote so that the fleet of assets can be liquidated in the event of a bankruptcy of the rental car company without a competing claim being made on behalf of the bankrupt party's creditors.

In a transaction where the lease is a finance lease, the vehicles will be titled in the name of the lessee. In that case, the vehicles would be included in the bankruptcy estate of the rental car company were it to file for bankruptcy. As a result, the finance lease should only be used in transactions funded through commercial paper where the risks of a bankruptcy are taken by a liquidity provider through a liquidity facility.

Bankruptcy Remote Special Purpose Entity

As with most structured finance securities, rental car ABS transactions use a bankruptcy-remote, SPE which is responsible for issuing securities and using the proceeds of that issuance to purchase vehicles under various purchase agreements with eligible manufacturers. The SPE is assigned the rights under these purchase agreements.

The SPE is normally administered by the rental car company under an administration agreement which specifies the responsibilities of the rental car company in the transaction. The Credit Analyst reviews this agreement which specifies the responsibilities of the rental car company in connection with this agreement. A back-up administrator may be appointed in order to mitigate concerns over the transfer of these functions if the rental car company goes into bankruptcy or otherwise cannot perform these functions.

Lease Payments with Rental Company

In a typical rental car fleet ABS deal, the SPE enters into a lease agreement with the rental car company through which the SPE leases the vehicles it has purchased for use in the rental car company's fleet. The rental car company is responsible for making monthly lease payments to the SPE under the terms of the lease agreements. The lease payments are designed to cover interest payments, vehicle depreciation, program carrying costs and other expenses associated with the transaction.

Recoveries from Buyback Agreements and Sales of Vehicles

The SPE enters into repurchase agreements with manufacturers to purchase vehicles that will then be leased to the rental car company as stated above. The SPE disposes of those vehicles by either returning them to the manufacturer under repurchase agreements or selling them into the used market (at-risk vehicles). The proceeds of these returns and sales are used during the amortization period as the primary source of funds for principal payments on the notes. The terms and conditions of these repurchase agreements include timing of the return of the vehicles, mileage limitations on the vehicles and damage standards which exclude normal wear and tear. They also state the repurchase price and payment timing by the manufacturer. If the return conditions are not met, then it may result in a reduction to the repurchase price under the agreement or those vehicles may no longer qualify for repurchase by the manufacturer.

Credit Enhancement

Credit enhancement for a rental car fleet ABS transaction may be provided through a combination of subordination, overcollateralization, letters of credit, cash and/or a surety bond. The amount of credit enhancement is determined through an analysis of the liquidation of the fleet. There is a portion of the credit enhancement which should be in liquid form in order to cover the payment of interest and expenses during a potential bankruptcy scenario of the rental car company, where lease payments may not be made.

Recharacterisation of Fixed Security Interest

There is a possibility that a court finds that the fixed security interests expressed to be created by the issuer under the deed of charge could take effect as floating charges as the description given to them as fixed charges is not determinative. Whether the fixed security interests will be upheld as fixed security interests rather than floating security interests will depend , among other things, on whether the security trustee has the requisite degree of control over the relevant assets and, if so, whether such control is exercised by the security trustee in practice. Where the chargor is free to deal with the secure assets, or any proceeds received on realization of the secured assets, without the consent of the chargee, the court would be likely to hold that the security interest in question constitutes a floating charge, notwithstanding that it may be described as a fixed charge. If the fixed security interests are recharacterised as floating security interests, the claims of certain statutorily defined preferential creditors of the relevant chargor may have priority over the rights of the relevant chargee, as the case may be, to the proceeds of enforcement of such security. A receiver appointed by the security trustee under the deed of charge would be obliged to pay preferential creditors out of floating charge realisations in priority to payments to the secured parties (including the noteholders). However, the only categories of preferential debts are certain amounts payable with respect to occupational pension schemes, employee remuneration and any statutory levies applicable. The issuer undertakes not have any employees.

Payment Terms under Repurchase Agreements – Receivables

Historically, manufacturers pay for these program vehicles under repurchase agreements within a certain number of days as specified in the repurchase agreement after the vehicles had been returned. This payment delay creates a receivable from the manufacturer.

As the credit quality of the Top-Tier auto manufacturers declined, there have been more concerns regarding the size of the receivable created from these repurchase obligations. As a result, the rental car companies and manufacturers have modified payment terms so that the vehicles are returned to a third-party auction site and the title is retained by the SPE until the vehicle is sold and the proceeds from the auction and other amounts due from the manufacturer are received.

Timeline of a Rental Car ABS Transaction

There are several phases in the life of a rental car ABS transaction. This includes the revolving period, a controlled amortization period and a rapid amortization period.

Revolving Period

During the revolving period of the transaction, interest payments are made on the notes but no principal payments are made. Principal proceeds from the lease payments and vehicle sales are used to purchase new vehicles (or pay down other series of notes that have reached their amortization period).

Controlled Amortization Period

The controlled amortization period follows the revolving period as long as no rapid amortization event has occurred. During the controlled period, there are scheduled principal payments on the notes in addition to ongoing interest payments. There may still be new vehicle purchases made from any cash flow in excess of that required for the scheduled principal and interest payments. The controlled amortization period is generally between 6 and 12 months in length and is designed to fully repay the notes by the expected final distribution date.

Rapid Amortization Period

A rapid amortization period takes place if certain negative events occur such as the breach of an early amortization event or event of default. These triggers are outlined below in the sections entitled "Lease Events of Default" and "Early Amortization Events", respectively. The consequence of tripping one of these triggers is to terminate the revolving period in the transaction and use all cash flow available to repay the notes on an accelerated basis. There are no new vehicle purchases and no cash flow is distributed to the rental car company during the rapid amortization period and there is an immediate disposition of the rental car fleet. The timing of that disposition depends upon fleet size, any bankruptcy issues and the ability of the lessee/servicer to dispose of the fleet on a rapid basis.

The legal final maturity date is normally set to be one year after the expected final date for a transaction. If the notes are not repaid by the final distribution date then an early amortization event goes into effect so that all notes can be repaid prior to the legal final maturity date.

Borrowing Base

The borrowing base must be maintained in a rental car ABS transaction in order to ensure that there are adequate assets to repay the asset-backed notes if there is a bankruptcy of the rental car company and liquidation of the fleet.

The borrowing base calculation is as follows:

- the net book value of program vehicles;

- the net book value on non-program vehicles;

- the accrued and unpaid lease payments due from the rental car company;

- receivables due from the investment grade manufacturers for program vehicles returned;

- receivables due from auctions;

- cash and permitted investments on deposit in the collection account.

Accounts receivable from below investment grade manufacturers, bankrupt manufacturers and those unpaid by 30 days and 90days after the sale of non-program vehicles, respectively, should be excluded from the borrowing base. If the borrowing base cannot be maintained then an early amortization event will be triggered.

Transaction Triggers

Lease events of default

Under the lease agreement with the rental car company, there should be certain events of default under which the SPE will no longer be permitted to enter into any further leases with the rental car company. These should include the following:

- Failure of the rental car company to pay principal or interest on any lease following the applicable grace period;

- Involuntary bankruptcy proceedings are initiated against the rental company;

- Failure of the rental company to comply with any provision of the applicable lease agreement that continues after the applicable grace period;

- Material breach of a representation or warranty of the rental car company as per the applicable lease agreement.

FILE PHOTO/COURTESY: Uganda Registration Services Bureau (URSB) | URSB Call for Tolerance in Insolvency Cases || ChimpReports

Early Amortization events

Rental car ABS transactions should include certain events which terminate the revolving structure for the deal and all cash flow repays investors as quickly as possible. This rapid amortization of a transaction should occur under the circumstance of certain events including the following:

- The issuer defaults in the payment owed on the notes and that default continues for a certain number of days.

- The issuer defaults in the payment of any principal due on the notes and this default continues for a certain number of business days;

- The issuer fails to comply with any other agreements, covenants or provisions of a series that materially and adversely affect the interest of the noteholder of any series for a certain number of business days;

- A borrowing base deficiency exists and continues for at least a specified number of business days;

- The liquidity amount is less than the liquidity amount required in the transaction;

- A lease event of default occurs and is continuing following the applicable grace period;

- The commencement of bankruptcy of the issuer or the rental car company which continues following the applicable grace period;

- Any representation or warranty made by the issuer is materially false and adversely affects the interest of the noteholders and is not cured within a specified number of days after written notice by the trustee on behalf of the noteholders,

Manufacturer Event of Default

A bankruptcy of one of the manufacturers supplying program vehicles to the fleet in a rental car ABS transaction is considered a manufacturer event of default. It may be immediate or with a built in time lag as per the transaction documents. If a manufacturer event of default occurs,the issuer must either repurchase and remove or supply additional credit enhancement for any vehicles owned pursuant to repurchase agreements with the bankrupt manufacturers.

In many transactions, the manufacturer event of default does not occur until 30 days after the bankruptcy filing. During this period, should the bankrupt manufacturer affirm their buyback obligations in court then a manufacturer event of default does not occur.

Rental Car Industry Overview

The rental car industry is divided into two segments: the on-airport segment and the local rental segment. The on-airport segment of the industry is significantly influenced by developments in the travel industry especially airline passenger traffic, or enplanements. The local rental segment serves commercial, leisure and insurance replacement customers.

Key Variables Impacting Rental Car ABS Transactions

There are three key variables which impact the performance and credit quality of rental car ABS transactions. The variables include: 1) the credit quality of the rental car company as servicer/operator of the fleet and lessee in the transaction; 2) the credit quality of the auto manufacturers of the fleet; and 3) the residual values of the fleet.

Rental Car Company

The performance of a rental car ABS transaction will be impacted by the credit quality of the rental car company as servicer/operator of the fleet and lessee in the transaction. This is due to the fact that the rental car company is responsible for making periodic lease payments to the special purpose entity ("SPE") and is responsible for servicing the rental fleet over the life of the deal. As such, the Credit Analysis of the rental car company includes an analysis of their performance as well as the operational capabilities as servicer/operator. However, these transactions are structured so that the underlying assets of the securitization, which are the vehicles in the fleet, are placed in a bankruptcy remote vehicle so they can be liquidated in the case of a bankruptcy of the rental car company. As a result, the requisite Credit Analysis is hinged on the likelihood of the rental car company filing for bankruptcy during the term of the transaction; however , it is typical for the analysis to be predicated on a bankruptcy scenario on the part of the car rental company as cushioned by the credit enhancement levels so as to reflect the amount needed under a bankruptcy scenario.

Credit Quality of the Auto Manufacturers

The deterioration of the credit quality of the Top-Tier auto manufacturers has in the recent resulted in a number of changes to the structure of rental car ABS transactions since they have direct exposures to the creditworthiness of auto manufacturers through their repurchase obligations on program vehicles. Program vehicles are those in which the manufacturer agrees to buyback the vehicles under certain terms at a specified price thereby reducing the rental car company's exposure to used car market fluctuations. Rental car ABS transactions have indirect exposure to the credit quality of the vehicle manufacturers for non-program vehicles to the extent that a manufacturer bankruptcy impacts the residual values of their vehicles.

In bankruptcy, a manufacturer may seek to terminate their obligation to buyback program vehicles from the rental car companies in the bankruptcy court. However, the likelihood of the manufacturers pursuing this termination of their buyback obligation to be somewhat remote as the rental car companies still represent relatively large new vehicle purchases for the manufacturers. The Car rental market accounted for USD 86 billion in 2020 and is expected to reach USD 131 billion by 2026, projecting a CAGR of about 7% during the forecast period. The rapid spread of COVID-19 is having an enormous impact on the travel and tourism industry affecting the car rental market in parallel.

Residual Values of the Vehicles in the Fleet

Rental car transactions are exposed to the residual values of the vehicles in the fleet as non program or "at-risk"vehicles are not subject to a buyback agreement with the manufacturers or may be ineligible program vehicles no longer subject to repurchase, so the value of those vehicles is realized through a sale into the used car market. The lease payments made under the lease by the rental car company are designed to cover the depreciation of the vehicles each month. These depreciation rates are determined for non-program vehicles based upon an estimated residual value for the vehicles when they are retired from the fleet. The extent to which vehicles do not depreciate in line with expectations will determine the amount of gain or loss on the sale of these vehicles at the time of disposition. As a result, it is prudent to analyze the potential volatility in the used car market to determine the amount of loss in residual value to which the transactions may be subject.

The structural features included in rental car ABS transactions which are intended to limit the extent to which these fluctuations impact the ABS transactions include: 1) a monthly marked-to-market test, 2) a monthly test on disposition proceeds to the net book value of vehicles sold ("measurement month test") and 3) a monthly comparison of the borrowing base in the transactions.

The marked-to-market test is a comparison of the market value of non-program and "adjusted program vehicles" over the net book value of those receivables. The adjusted program vehicles which have been re-designated as non-program vehicles following the bankruptcy of the manufacturer; these vehicles of the bankrupt manufacturer are not included in the calculation for 90 days following bankruptcy.

The measurement month test compares the actual disposition proceeds of vehicles sold against the net book value of those vehicles. These two tests are designed to keep the net book value of the fleet in the borrowing base in line with the market value that could be realized in the used car market. The results of the two tests are compared and the test requiring the higher amount of additional credit enhancement will apply. The borrowing base is then calculated to ensure that there are sufficient assets available to repay the asset-backed notes in the event of a bankruptcy of the rental car company and liquidation of the fleet.

These structural protections limit the time frame that the residual value is at risk for the securitization transaction to the time between the last marked-to-market and measurement month tests and the sale of the vehicles in the market. This time frame relates to the time it takes to obtain possession of the rental car fleet and liquidate it.

Concluding Nuggets of Wisdom

1) I am proud to note that this #40Days40Fintechs initiative is one of the very few projects that I have witnessed, where participants get real value, by getting once in a lifetime chance to have highly competent team dedicate it's time at documenting their solution, which is then showcased not only in Uganda, but across the world. In my experience, very few projects truly manage to achieve their intended purpose." – Ambassador Damali Ssali, Founder – Ideation Corner

2) "No Retreat , No Surrender : Advocacy for Whole Business Securitization (WBS) as the Panacea for the Economic Malaise plaguing the African Continent is the way to go; Let us embrace #AfCFTA , #FinTech , #DEI , #ESG, among others to reap the benefits akin to those enjoyed by the Developed World whose Lending Rates are near Zero Percent (0%)." – Faith Nassiwa

Acknowledgements

1) DBRS

Wednesday, December 29, 2021

iSPECIAL TREASURES THE PEARL OF AFRICA - UGANDA

iSPECIAL MOBILITY ECOSYSTEM

UGANDA │ TREASURE THE PEARL , RIDE SPECIAL MOBILITY │ "MY AFRICAN JOURNEY" : A LANDMARK TOURIST 'MUST READ' BOOK COLLECTION ITEM ABOUT THE PEARL OF AFRICA – SIR WINSTON LEONARD SPENCER CHURCHILL, KG, OM, CH, TD, DL, FRS, RA ( 30 NOVEMBER 1874 – 24 JANUARY 1965).

Uganda – The Pearl of Africa

Country in East Africa

"Uganda is a landlocked country in East Africa whose diverse landscape encompasses the snow-capped Rwenzori Mountains and immense Lake Victoria. Its abundant wildlife includes Chimpanzees as well as rare birds. Remote Bwindi impenetrable National Park is a renowned mountain gorilla sanctuary. Murchison Falls National Park in the north west is known for its 43 m-tall waterfall and wildlife such as hippos."

"Uganda is bordered to the East by Kenya, to the North by South Sudan, to the West by the Democratic Republic of the Congo, to the South-West by Rwanda, and to the South by Tanzania. The Southern part of the country includes a substantial portion of Lake Victoria, shared with Kenya and Tanzania. Uganda is in the African Great Lakes region. Uganda also lies within the Nile basin and has a varied but generally a modified equatorial climate. It has a population of over 42 million, of which 8.5 million live in the Capital and the largest city Kampala." – Uganda – Wikipedia

The slogan – the Pearl of Africa – was made famous by Winston Churchill in his 1908 Book entitled "My African Journey" about his trip to Uganda in 1907.

YouTube Video | Explore Uganda , The Pearl of Africa : Rediscover and fall in love with Uganda|#ExploreUganda #UniquelyOurs 👇🏾

Related Sights and Sounds that the Pearl of Africa Offers:

- YouTube Video | Displore : Ten (10) Best Places to Visit in Uganda 👇

Winston Churchill was quite enthused about what he found in Uganda as attested by his remarks: "For magnificence, for variety of form and color, for profusion of brilliant life – bird, insect, reptile, beast – for vast scale – Uganda is truly "the Pearl of Africa."

Why is Uganda called the Pearl of Africa, and who was the first to use the slogan ?

Most in Uganda today attribute the name "Pearl of Africa" to Winston Churchill. However, almost every other Western Explorer and Discoverer that came to Uganda felt similar sentiments about the country. They spoke in glowing terms about the country they found and referred to as the Pearl of Africa.

Yes, Winston Churchill may not have been the one who first called Uganda the Pearl of Africa albeit he is the one who today is given credit. It was Winston Churchill who popularized it through his book, "My African Journey", a Book that one can buy on amazon.com and the same is strongly recommended to read before venturing into a tumultuous tourism sojourn to Uganda.

The Pearl Tourism Ecosystem: The Key Players in the Industry

A shortlist of our Partner Tour Packages

Among our Partner Popular Packages

• 22 Days – The Big Circuit

• 11 Days – Uganda Trail

• 9 Days – Queen Elizabeth & Bwindi

• 8 Days – Rwenzori Mountains

• 7 Days – Round Trip Uganda

• 12 Days – Uganda Birding Safari

• 7 Days – Birding Special

• 5 Days – Mountain Elgon Hiking

• 5 Days – Murchison & Kibale

• 3 Days – Murchison Falls National Park

• 3 Days – Chimpanzee Tracking in Kibale

• 3 Days – Gorilla Trekking at Bwindi

• 3 Days – Queen Elizabeth National Park

• 2 Days – Chimpanzee Trekking in Kibale

• 1 Day Trip – Whitewater Rafting on the Nile

YouTube Video | Sky Travel |Travel Guide || Fifteen (15) Best Places to Visit in Uganda 👇🏾

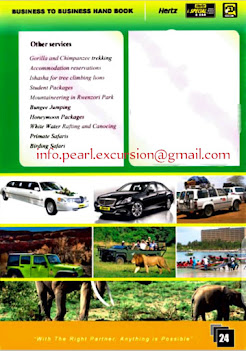

Other Partner Services

• Gorilla and Chimpanzee Trekking

• Accommodation Reservations

• Ishasha for Tree Climbing Lions

• Student Packages

• Mountaineering in Rwenzori Park

• Bungee Jumping

• Honey Moon Packages

• White Water Rafting and Canoeing

• Primate Safaris

• Birding Safari

A shortlist out of More than 1000 reasons for Visiting and/or Investing in Uganda:

Uganda is indeed the right place, and the time is now!! Visit Uganda , Invest in Uganda now...

Here is why:

• Stable average 5.3% GDP growth in the 5 years to 2019 (pre-COVID) according to The World Bank ;

• Abundant raw materials – minerals, oil and gas, major cash crops creating endless opportunities for value addition;

• Significant business reforms across government spearheaded by Uganda Registration Services Bureau (URSB) and Uganda Investment Authority that make it faster and cheaper to set up business in Uganda;

• Reforms and technology investments by Uganda Revenue Authority (URA) that have hugely reduced the time and cost of compliance as well as time taken to clear goods;

• Enhanced nationwide transport infrastructure coverage by Uganda National Roads Authority (UNRA) that lowers the time and cost needed to access markets in and around Uganda;

• Border-to-Border Peace and Security;

•A young educated and skilled labour force that is ready to work;

•Central location in Africa coupled with regional integration and trade agreements creates access to a home market of circa 42 million people: East African Community Market of 177 million and over 560 million people under COMESA

• Strategic trade Agreements and Treaties with the US, Europe and China, guarantee access to markets for several goods manufactured in Uganda;

• Numbers do not lie – we are the most competitive tourism destination in sub-Saharan Africa with the richest and most diverse attractions, moreover, over a smaller geographic area. This guarantees the highest return on investment for tourists and tourism investors alike;

• Abundant electricity with some of the most competitive tariffs for large users in the region.

Courtesy: Muhereza Kyamutetera

Pearl of Africa Snapshot Gallery

■Margherita Peak, Snow capped Mt. Rwenzori

■ New Nile Bridge

■ Entebbe Expressway

■ Namanve Industrial Park

■ Uganda Parliament

■ Kampala Serena Hotel

Subscribe to:

Comments (Atom)

iSPECIAL QUEST FOR AN INITIAL USD($)110M WORTH OF ASSET BACKED SECURITIES, THE FIRST IN UGANDA SINCE GAZETTING THE REGULATIONS ON JUNE 29, 2012

iSPECIAL MOBILITY ECOSYSTEM ASSET BACKED SECURITY UGANDA: CAPITAL MARKETS (ASSET BACKED SECURITIES) REGULATIONS, 2012 "An asset ba...

Trending Posts

-

iSPECIAL MOBILITY ECOSYSTEM ASSET BACKED SECURITY UGANDA: CAPITAL MARKETS (ASSET BACKED SECURITIES) REGULATIONS, 2012 "An asset ba...

-

iSPECIAL MOBILITY ECOSYSTEM Trust Law inherent in the Discharge and Appropriation of the Lessee/Lessor Interest in Financed Assets (DALIFA...

-

iSPECIAL MOBILITY ECOSYSTEM UGANDA │ TREASURE THE PEARL , RIDE SPECIAL MOBILITY │ " MY AFRICAN JOURNEY " : A LANDMARK TOURIST ...

-

iSPECIAL MOBILITY ECOSYSTEM Human Capital Deployment Strategy OPINION: EMPLOYEES VS SELF EMPLOYED WORKERS INTRODUCTION: "While gig wo...

-

iSPECIAL MOBILITY ECOSYSTEM Car Leasing Business Model Foreword: In 1959, Charles W. Steadman stated: "[This] leasing activity is confi...

-

iSPECIAL MOBILITY ECOSYSTEM Strategic Partnership and Collaboration Aspirations FOREWORD│ MAK AND STANBIC DISCUSS PARTNERSHIP BEYOND BANKING...

-

iSPECIAL MOBILITY ECOSYSTEM In-Country and/or Transient End User Ground Transportation Procedure FOREWORD: "Incredible innovations wi...